Rent Receipts in India: Key Tips and Latest Updates

Renting a property is a common practice in India, and it comes with certain responsibilities for both landlords and tenants. One crucial aspect of this arrangement is the issuance and acceptance of rent receipts. In this comprehensive guide, we will explore the significance of rent receipts, their legal implications, and provide an in-depth analysis of the rent receipt format in India. Drawing on the latest news and sources, we aim to provide readers with a thorough understanding of the importance of proper documentation in the realm of rental agreements.

The Legal Importance of Rent Receipts in India

Rent receipts play a crucial role in the legal framework governing landlord-tenant relationships in India. They serve as documentary evidence of the payment of rent and are vital for various purposes, including income tax filings, address verification, and legal disputes. Both landlords and tenants should understand the legal implications and importance of maintaining accurate and well-structured rent receipts.

Latest Developments and News on Rent Receipts

In recent years, there have been notable developments in the legal landscape concerning rent receipts in India. Government authorities and financial institutions have emphasized the need for transparency and adherence to proper documentation in real estate transactions. The news highlights instances where individuals faced challenges due to the absence of clear rent receipts, leading to legal disputes and financial complications.

It is essential for both landlords and tenants to stay informed about the latest regulations and expectations surrounding rent receipts to ensure compliance and mitigate potential issues.

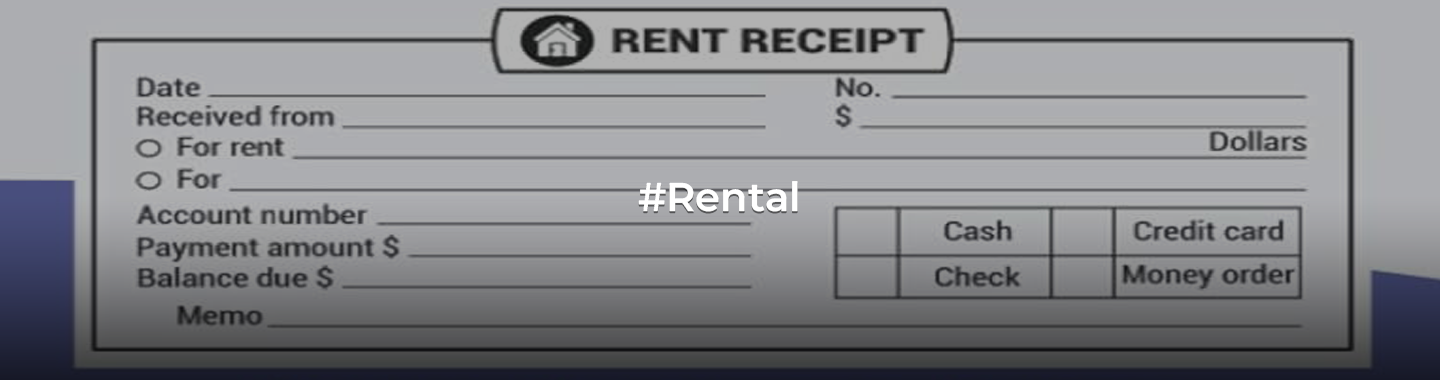

Key Components of a Rent Receipt Format in India

- Header Information: The rent receipt should begin with a header containing essential information such as the landlord’s name, address, and contact details. Similarly, the tenant’s name, address, and contact details should also be clearly mentioned. This section establishes the identities of both parties involved.

- Receipt Number and Date: Each rent receipt should have a unique identification number, and the date of issue should be prominently displayed. This helps in organizing records and tracking payments over time.

- Details of the Property: The rent receipt should specify the details of the rented property, including its address, type (apartment, house, etc.), and any other relevant descriptors. This ensures clarity regarding the specific premises for which the rent is being paid.

- Rental Period: Clearly mention the duration for which the rent is being paid. This can include the specific month or a defined time frame (monthly, quarterly, etc.). Clarity on the rental period helps in avoiding misunderstandings or disputes.

- Amount Paid: State the exact amount paid by the tenant, both in numerical and written formats. It is crucial for the figure mentioned on the rent receipt to match the actual rent paid to avoid discrepancies.

- Mode of Payment: Indicate the mode of payment used by the tenant (cash, check, online transfer, etc.). This information helps in cross-referencing with bank statements and serves as additional proof of payment.

- Signature and Seal: Both the landlord and the tenant should sign the rent receipt to acknowledge the payment. If the landlord represents a registered entity, a seal or stamp should also be affixed to validate the document.

- Acknowledgment: A brief acknowledgment statement, confirming the receipt of the specified amount for the mentioned rental period, adds an extra layer of clarity to the document.

- Additional Terms and Conditions: If there are any specific terms or conditions related to the rental agreement, such as maintenance charges, security deposit details, or utility payments, they can be included in the rent receipt for comprehensive documentation.

- GST Compliance (if applicable): In cases where Goods and Services Tax (GST) is applicable, landlords must include their GST identification number and comply with the GST regulations in the rent receipt format.

Rent Receipts and Income Tax Compliance

Apart from their role in the landlord-tenant relationship, rent receipts are crucial for income tax purposes, especially for tenants. In recent years, the income tax department has increased scrutiny on rental income, necessitating accurate documentation. Tenants can claim House Rent Allowance (HRA) exemptions by providing rent receipts to their employers.

As per the latest news, the income tax department has been focusing on ensuring that individuals claiming HRA deductions submit authentic rent receipts with correct details. Failure to provide accurate documentation may lead to the disallowance of HRA exemptions, resulting in additional tax liabilities for the tenant.

Tips for Tenants on Rent Receipts

- Request Receipts Promptly: Tenants should ensure that they receive rent receipts promptly after making the payment. Timely issuance of receipts helps in maintaining organized records.

- Keep Digital Copies: In today’s digital age, it is advisable to keep digital copies of rent receipts as backup. This ensures that even if physical receipts are misplaced, there is a digital trail for reference.

- Regularly Review and Cross-Check: Tenants should regularly review their rent receipts and cross-check them with their bank statements to ensure that the amounts match and there are no discrepancies.

- Seek Clarity on Terms: If there are any terms or conditions mentioned in the rent receipt that are unclear, tenants should seek clarification from the landlord. It is essential to have a mutual understanding of all aspects related to the rental agreement.

Tips for Landlords on Issuing Rent Receipts

- Issuing Receipts Promptly: Landlords should ensure that they issue rent receipts promptly after receiving payments. This not only helps in meeting legal obligations but also fosters a transparent and professional relationship with tenants.

- Maintaining Consistency: Landlords should maintain consistency in the format and content of rent receipts issued. This makes it easier for tenants to organize their records and ensures uniformity in documentation.

- Providing Additional Details: Including additional details in the rent receipt, such as the purpose of any additional charges or the breakdown of the rent amount, can contribute to transparency and reduce the likelihood of disputes.

- Being GST Compliant: Landlords who fall under the purview of GST regulations should ensure that their rent receipts are GST compliant. This includes mentioning their GST identification number and adhering to GST guidelines.

Conclusion: The Importance of Rent Receipts in India

Rent receipt formats are integral to the smooth functioning of landlord-tenant relationships in India. As legal frameworks evolve and income tax regulations become more stringent, the importance of accurate and comprehensive rent receipts cannot be overstated. Both landlords and tenants should familiarize themselves with the latest developments, ensuring that their rent receipts adhere to legal requirements and serve as reliable documentation for various purposes.

In an era where transparency and accountability are paramount, the proper handling of rent receipts is not just a formality but a crucial aspect of responsible property management. By understanding the key components of a rent receipt format, staying informed about the latest news and regulations, and maintaining open communication, landlords and tenants can contribute to a positive and legally compliant rental experience.

Disclaimer: The views expressed above are for informational purposes only based on industry reports and related news stories. PropertyPistol does not guarantee the accuracy, completeness, or reliability of the information and shall not be held responsible for any action taken based on the published information.